Germany has a very structured and professional freelance scene: the system is clear but requires strict adherence to regulations. Embarking on a freelancing career in Germany offers numerous opportunities, but it's essential to navigate the legal, tax, and financial landscapes effectively. This guide provides a step-by-step approach to help you establish a successful freelancing business in Germany.

You need to determine your professional category and register with the tax office. It will allow you to open a business bank account, secure your health insurance. The next phase is to create a professional portfolio, then start networking and finding clients.

The economy is robust, with high demand for freelancers in engineering, IT, and specialized manufacturing. For foreigners, Germany is exceptionally attractive due to its strong economy, high rates of pay, and relative administrative clarity. Berlin is a major startup and tech hub, creating demand for developers, designers, and digital marketers.

Disclaimer: This guide is current as of 2025 and subject to change. Always consult with a local tax advisor and official sources for the most up-to-date information.

Step 1: Determine Your Freelance Status in Germany

In Germany, freelancers are categorized based on their profession:

- Freiberufler (Liberal Professionals)

- Applies to liberal professions (e.g., writers, designers, consultants, doctors, architects)

- No trade license (Gewerbeschein) needed

- Register directly with the tax office (Finanzamt)

- List of approved professions: BMF Official List (in German)

- Gewerbetreibende (Tradespeople)

- Applies if you sell products, offer non-liberal services (e.g., e-commerce, catering)

- Requires a Gewerbeanmeldung (trade registration) at the local Gewerbeamt

- Subject to trade tax (Gewerbesteuer)

Identifying your category is crucial, as it affects your registration process and tax obligations.

Industry-Specific Freelancing Tips for Germany

Writers, Translators & Editors

- VAT Exemption: If working for international clients outside the EU, apply for §6a UStG (reverse charge)

- Platforms: Textbroker, Upwork, ProZ

- Deductions: Language courses, proofreading tools (Grammarly), reference books

Designers & Creatives (Graphic Design, UX/UI, Video)

- VAT on Digital Goods: 19% for digital products (e-books, templates)

- Platforms: Behance (for exposure), 99designs, Fiverr Pro

- Deductions: Adobe Creative Cloud, Canva Pro, hardware (tablets, monitors)

IT & Software Developers

- Contract Types: Distinguish between Freelance (Freiberufler) and Gewerbe (if selling software)

- Platforms: Toptal, Gulp, Stack Overflow Jobs

- Deductions: GitHub Pro, cloud services (AWS), conferences (re:publica)

Consultants (Business, Marketing, Coaching)

- Legal Structure: If earning >€250k/year, consider a UG (mini-GmbH) for tax benefits

- Networking: Join Xing groups, attend IHK events

- Deductions: CRM tools (HubSpot), LinkedIn Premium

Real Estate & Architects

- Mandatory Chamber Membership: Architects must register with the Architektenkammer

- VAT on Services: Usually 19%, but reduced for some public projects

Food & Hospitality (Catering, Food Blogging)

- Gewerbe Required: Must pass health inspections

- Deductions: Kitchen equipment, food safety courses

Useful Official Resources

Government Websites

Support Organizations

- Gründerplattform (Startup Support)

- IHK (Industry and Commerce Chamber)

- Wirtschaftsförderung (Economic Development Agencies)

Financial Management Tips

- Use Time-Tracking Tools (Toggl, Clockify) to log billable hours

- Use accounting software (Lexware, DATEV)

- Set aside 30–40% of Income for taxes (avoid surprises)

- Track all business expenses (gather receipts and list monthly costs)

- Get Liability Insurance (Berufshaftpflichtversicherung) – crucial for consultants & creatives

- Charge Late Fees (Mahngebühren) – German law allows €40+ for overdue invoices

Potential Challenges and Solutions

Common Freelancer Challenges

- Irregular income

- Health insurance costs

- Bureaucratic processes

- Competition

Mitigation Strategies

- Diversify client base

- Create a strong online portfolio

- Continuous skill development

- Build a professional network

Estimated Costs and Budgeting

Monthly Estimated Expenses

- Health Insurance: €300-€500

- Accounting Software: €20-€50

- Professional Association Fees: €100-€200

- Marketing and Networking: €50-€150

Professional Development

- Join professional associations

- Continuous skill upgrading

- Network through XING and LinkedIn

- Attend industry conferences

When to Upgrade from Freelancer to Company?

Consider forming a GmbH or UG if:

- You earn >€100k/year (lower corporate tax rate)

- You want liability protection

- You plan to hire employees

Cost: ~€500–€1,500 (notary + registration).

Final Checklist for Success

- Choose the right legal structure (Freiberufler vs. Gewerbe)

- Register with Finanzamt & health insurance

- Find a tax advisor (or use digital tools like Wundertax)

- Join industry-specific platforms (Upwork, Gulp, Behance)

- Track expenses & save for taxes

Need personalized advice? Book a consultation with an English-speaking tax advisor via Sorted or GetStarted.

Contract Templates & Liability Insurance Guide

To protect yourself legally and financially, you’ll need solid contract templates and liability insurance. Below are the best options for freelancers in Germany.

Freelance Contract Templates (Vertragsvorlagen)

A well-drafted contract prevents payment disputes and clarifies responsibilities.

Where to Get Contracts (Free & Paid)

| Type | Best For | Source | Cost | Language |

|---|---|---|---|---|

| General Freelance Agreement | All freelancers | Honorvertrag (IHK) | Free | German |

| IT & Development Contracts | Developers, Tech | GitHub Templates | Free | English |

| Design & Creative Work | Designers, Artists | Designbundles Contract | €10–€30 | English/German |

| Consulting & Coaching | Business Consultants | PandaDoc | Free trial | English |

| International Clients | Cross-border work | Docracy | Free | English |

Pro Tip:

- Use e-signature tools like DocuSign or Adobe Sign for legal validity

- Try to always include:

- Scope of work (Leistungsbeschreibung)

- Payment terms (Net 14/30 days)

- Cancellation policy (Kündigungsfrist)

- Liability clauses (Haftungsausschluss)

Liability Insurance (Berufshaftpflichtversicherung)

Mandatory for some professions, but highly recommended for all freelancers to cover legal claims.

Who Needs It Most?

- IT & Developers (bug causes client financial loss)

- Consultants & Coaches (bad advice leads to damages)

- Designers & Creatives (copyright infringement claims)

- Health & Wellness (yoga instructors, nutritionists)

Best Liability Insurance Providers

| Provider | Coverage | Cost (Monthly) | Best For | Link |

|---|---|---|---|---|

| Hiscox | €1M–€5M | €15–€50 | IT, Consultants | hiscox.de |

| Allianz | Full legal protection | €20–€60 | High-risk jobs | allianz.de |

| HanseMerkur | Flexible plans | €10–€40 | Creatives, Coaches | hansemerkur.de |

| GetSafe | Digital-first, English support | €12–€35 | Expats, Startups | getsafe.com |

| DFV | Budget-friendly | €8–€25 | Writers, Translators | dfv.de |

Pro Tip:

- Check if your professional association (e.g., Architektenkammer, Journalistenverband) offers discounted group insurance

- Minimum coverage: €1M (€3M recommended for high-risk fields)

Additional Legal Protections

Legal Expense Insurance (Rechtsschutzversicherung)

Covers lawyer fees in disputes (e.g., unpaid invoices, contract breaches).

- Top Providers: ARAG, Roland, Allianz (~€20–€40/month)

- Tailored Providers for Expats: Feather, Getsafe, MW Expat (~€5–€50/month)

Equipment Insurance (Berufsgeräteversicherung)

Covers laptops, cameras, and tools against theft/damage.

- Best Option: HUK24 (€5–€15/month)

Final Checklist

- Use a contract (tailored to your industry)

- Get liability insurance (minimum €1M coverage)

- Consider legal insurance (if dealing with high-risk clients)

- Ensure expensive equipment (if working with hardware)

🚀 Need help reviewing a contract or choosing insurance? Try:

Sources:

- Welcome Center: Freelancing in Germany (tips and legalities)

- Clevver: All you need to know about freelancing in Germany

- Live in Germany: Best Business Account in Germany for Freelancers

- Accountable: The ultimate guide on how to start freelancing in Germany as an expat

Step 2: Legal Registration for EU Citizens

Registration Process

Tax Registration (Steuerliche Anmeldung)

- Register at the local tax office (Finanzamt)

- Freiberufler -> Submit a Fragebogen zur steuerlichen Erfassung (tax questionnaire) to your local Finanzamt. Download the form here

- Required documents:

- Passport/ID

- Proof of address

- Detailed description of professional activities

Official Registration (Anmeldung)

- Register at the local municipality (Rathaus)

- Register at the local Gewerbeamt (costs ~€20–€60)

- Check local requirements: IHK Germany

- Required documents: Bundesverwaltungsamt

Upon registration, you'll receive a tax number (Steuernummer) necessary for invoicing and tax filings.

Sources:

- LinkedIn: Freelancing in Germany – Step by Step Guide

- Kummuni: Freelancing in Germany

- Wise: Self-employed in Germany

- Abillio: Legal Setups and Taxation in Germany

- Joberty: Guide to Freelancing in Germany

Legal Structures

- Sole Proprietorship (Einzelunternehmer)

- Freelance Partnership (Freiberufliche Gesellschaft)

- Limited Liability Company (GmbH)

Step 3: Freelancer Visa (Freiberufler Visa) for Non-EU/EEA Citizens

You need a freelancer visa if:

- You are a non-EU/EEA citizen (EU/EEA citizens can work freely without a visa)

- You plan to work self-employed (not as an employee)

- Your freelance work benefits the German economy (e.g., demand for your profession)

You’ll need a Freelancer Visa (officially called the "Aufenthaltserlaubnis für selbständige Tätigkeit").

1. Eligibility Criteria

To qualify for the freelancer visa, you must meet certain requirements:

1.1. Your profession must qualify as a "liberal profession" (Freiberufler) under German law. Common professions include:

- Creative fields: Writers, artists, designers, photographers

- Tech & IT: Software developers, consultants

- Health & Education: Teachers, doctors, therapists, coaches

- Legal & Financial: Lawyers, accountants

1.2. Clients in Germany – You must provide contracts or letters of intent from potential German clients.

1.3. Financial Stability – Proof that you can support yourself financially (usually bank statements or proof of income).

1.4. Health Insurance – You need valid health insurance (public or private) covering you in Germany.

1.5. German Address – You must be registered at a German address (Anmeldung).

Types of Freelance Work Permits

- Freiberufler visa: For liberal professionals like artists, writers, consultants, engineers

- Gewerbetreibender (business visa): For commercial/trade business activities

2. Required Documents

When applying for the freelancer visa, you will need:

- Completed visa application form (Available at the German embassy or download here)

- Passport (Valid for the entire duration of your stay)

- Passport-sized photos (Biometric format 35x45 mm)

- Cover letter (Explaining why you want to freelance in Germany)

- Business plan (Outlining your services, target clients, and financial projections)

- Proof of expertise (Diplomas, certificates, portfolio, or reference letters)

- Letters of intent or contracts from 2–3 German/EU clients (to prove your business will generate income)

- Proof of financial stability (~€5,000–€10,000 in a savings bank account or steady income)

- Health insurance certificate (Covering at least basic medical expenses)

- Registration of residence (Anmeldung) – Proof that you live in Germany

Note:

- Some professions may require additional permits from professional bodies in Germany

- You must prove that your work does not compete unfairly, being a threat to the German Economy

Special Cases:

- Artists & Creatives: Easier approval (via Künstlersozialkasse)

- IT Freelancers: High demand, but must show client demand

The application process follows these steps from abroad:

Step 1: Apply for a National Visa (Before Entering Germany)

- If you are outside Germany, apply for a Type D Freelancer Visa at your local German embassy/consulate

- Informative articles on Germany Visa and All About Berlin

- Submit all documents, pay the visa fee (€75-€100), and attend an interview

- Processing Time: Typically 4-12 weeks (depends on the local authority)

Step 2: Enter Germany and Register Your Address

- Once in Germany, you must register your address at the local Einwohnermeldeamt (Resident Registration Office) within 14 days

Step 3: Apply for a Residence Permit

- Initial visa validity: 1–3 years (renewable if you still meet the requirements)

- After 5 years, apply for permanent residency (Niederlassungserlaubnis). Book an appointment at the local Ausländerbehörde (Foreigners' Office) to apply for a Freelancer Residence Permit

- Submit updated documents, including your tax registration (Steuernummer) and business activities

Note: The application process follows these steps if you are already in Germany:

- Switch from a tourist, job-seeker, or student visa

Useful Official Links (in German and English)

- German Government Visa Information: https://www.auswaertiges-amt.de

- German Immigration Office (Ausländerbehörde): https://www.bamf.de

- Freelancing & Taxes Guide: https://www.bundesfinanzministerium.de

3. Freelancer Visa vs. Freelance Business Visa

| Freelancer Visa (Freiberufler) | Business Visa (Gewerbe) |

|---|---|

| For liberal professions (art, consulting, IT) | For trades, shops, restaurants |

| No Gewerbeanmeldung needed | Requires a trade license |

| Easier approval for artists | Needs business plan + €25K+ investment |

4. Common Rejection Reasons & Solutions

- Not a "liberal profession" → Switch to business visa

- Insufficient income proof → Show more contracts/savings

- No German clients → Partner with local agencies

Pro Tip:

- Apply in Berlin, Hamburg, or Munich (more freelance-friendly)

- Hire an immigration lawyer if rejected (~€500–€1,500)

5. After Getting the Visa

- Register with Finanzamt (tax number)

- Get liability insurance (Berufshaftpflicht)

- File taxes annually (or quarterly if VAT-registered)

Useful Links

- Official Visa Info: German Missions Abroad

- Legal Help: Red Tape Translation

🚀 Need help with your application? Try:

- Expath (expath.com) – Visa consulting

- Berlinovo (berlinovo.de) – Support for freelancers

Step 4: Tax Obligations

- Income Tax (Einkommensteuer): Freelancers are subject to income tax based on their earnings.

- Progressive rates (14%–45%)

- Advance payments (quarterly): Estimated by Finanzamt

- Tax return deadline: July 31 (next year)

- Trade Tax (Gewerbesteuer): for certain professions

- Only for Gewerbe, not Freiberufler.

- Rate varies by municipality (~7–17%)

- Value Added Tax (Umsatzsteuer): mandatory if annual turnover exceeds €22,000 (2024 Threshold)

- Apply via Finanzamt (included in tax questionnaire)

- Standard Rate: 19%

- Reduced Rate: 7% for specific goods and services

- Small Business Regulation (Kleinunternehmerregelung): If your annual revenue is below €22,000 in the first year and €50,000 in subsequent years, you may be exempt from charging

- Advance Tax Payments: Based on your projected income, the Finanzamt may require quarterly prepayments to cover income and VAT liabilities

- File VAT returns monthly/quarterly via ElsterOnline: Elster Portal

Deductions & Expenses

- Home office (€1,250/year max)

- Equipment, software, travel, insurance

- Keep receipts for 10 years

Pro Tip: Use tax software like WISO Steuer or hire a Steuerberater (tax advisor).

Tax Recommendations & Industry-Specific Tips

Below are tax accountant recommendations, industry-specific advice, and additional pro tips to optimize your freelancing journey in Germany.

- Tax Accountant (Steuerberater) Recommendations

Hiring a Steuerberater (tax advisor) is highly recommended if:

✔ You earn >€50,000/year

✔ You’re unsure about VAT, deductions, or tax filings

✔ You want to minimize tax liability legally

- Where to Find a Good Tax Accountant?

| Service | Best For | Cost | Link |

|---|---|---|---|

| Steuerberaterkammer (Official Chamber) | Verified professionals | €100–€300/hr | Find Here |

| Wundertax | Digital tax filing (English-friendly) | ~€100–€300/year | wundertax.de |

| Taxfix | Simple tax returns | ~€40–€80 | taxfix.de |

| Sorted (Expat-focused) | English-speaking accountants | €50–€150/month | sorted.berlin |

| ELSTER (Free Official Portal) | DIY tax filing (German only) | Free | elster.de |

Pro Tip: Ask for a "Festpreis" (fixed price) instead of hourly rates to avoid surprises.

Tax Rates (2025 Estimates)

- Basic tax-free allowance: €10,908 per year

- Progressive tax rates:

- 14% for income between €10,908 - €15,999

- Up to 45% for income above €265,326

Important Tax Documents

- Annual tax return (Steuererklärung)

- Income statement (Einkommensteuerbescheid)

- VAT declarations (Umsatzsteuererklärung)

Recommended Tax Tools

- DATEV Unternehmer-Online

- Lexware financial software

- Sorted.de (tax optimization platform)

Step 5: Banking, Invoicing, and Financial Management

Recommended Bank Accounts for Freelancers

- Online Banks

- Kontist: Tailored for freelancers and solo entrepreneurs in Germany, a smart, tax-focused business account with automated VAT calculations, real-time tax estimates, and seamless ELSTER integration—hassle-free financial management and German tax compliance

- Fyrst: Offers free accounts to freelancers and self-employed professionals in Germany, a mobile-first business account with automated bookkeeping, real-time tax estimates, and integrated invoicing—streamlined financial management and German tax compliance

- ING: Offers freelancers and businesses a fully digital banking experience with free business accounts, integrated accounting tools, SEPA instant transfers, and a free Visa debit card, all with no monthly fees for the first two years

- Revolut Business: Offers freelancers and small businesses in Germany a fast, multi-currency online banking solution—all with low fees and real-time FX exchange

- N26 Business: A digital bank with a user-friendly interface and low fees–100% mobile business account with free basic banking, instant SEPA transfers, real-time spending insights, and integrated financial tools

- Traditional Banks with Freelancer Options

- Deutsche Bank:Business account with German IBAN, online banking, SEPA transfers, and integration with local tax tools

- Sparkasse: Reliable, branch-supported business account with German IBAN, SEPA transfers, and local advisory services

- Commerzbank: Hybrid business account combining German IBAN reliability with digital tools, including free online banking, SEPA transfers, and optional branch support

Each bank has its own set of features, so it's advisable to compare them based on your specific needs.

Essential Financial Practices

- Separate business and personal accounts

- Monthly bookkeeping

- Create invoices with clear payment terms

- Maintain emergency fund (3-6 months of expenses)

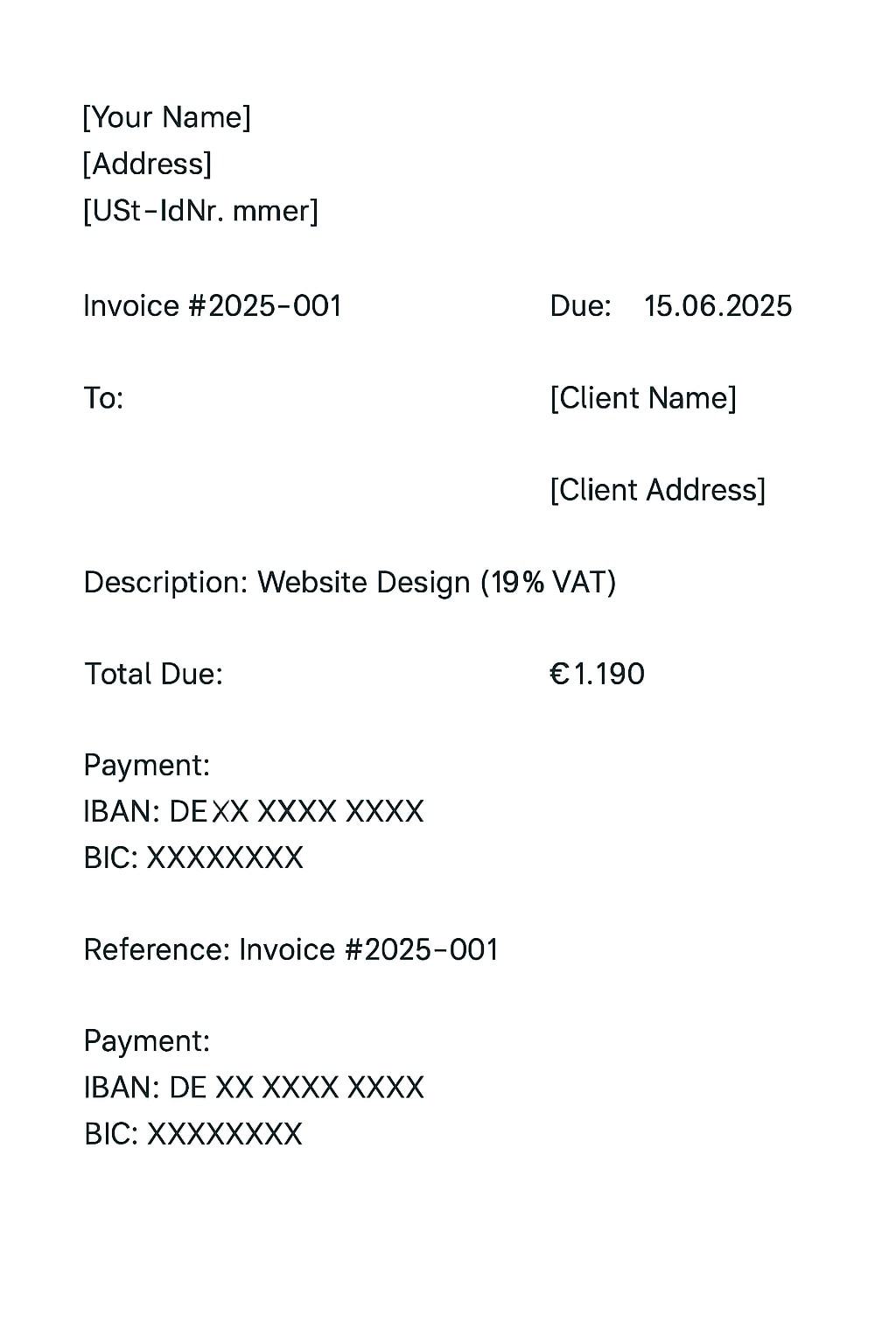

Invoicing Requirements

- Your invoice must include:

- Your name, address, tax number (Steuernummer)

- Client’s name & address

- Invoice number & date

- Description of services (Leistungsbeschreibung)

- VAT ID (USt-IdNr.) if registered

- Payment details (IBAN, due date)

- Mandatory e-invoice/e-invoicing (E-Rechnung):

- A mandatory e-invoicing (electronic invoicing) was introduced for B2B transactions starting January 1st of 2025, based in Germany

- Use tools: Lexoffice, SevDesk, Debitoor, DATEV

Example Template:

Recommended Invoicing Workflow

- Create invoice (Lexoffice/SevDesk)

- Send via email (PDF + QR-Rechnung + E-Rechnung)

- Track payments (accounting tool)

- Send reminder (automated after 14 days)

- Export for tax filing (ELSTER or tax advisor)

Final Checklist

- Choose an invoicing tool (Lexoffice, SevDesk, Zervant)

- Set up payment methods (SEPA, Wise, PayPal)

- Follow German invoice rules (VAT, references)

- Automate reminders for late payers

How to Ensure On-Time Payments

- Set clear payment terms (e.g., "Net 14 days")

- Charge late fees (Mahngebühren, typically €40+ after 30 days)

- Send automatic reminders (via Lexoffice, SevDesk)

- Use prepayments (50% upfront) for new clients

Late Payment Law (Germany):

- After 30 days overdue, you can charge a €40 late fee + 9% interest p.a.

Best Invoicing Tools & Payment Solutions (2024)

Managing invoices and getting paid on time is crucial for freelancers. Below are the top invoicing tools, payment gateways, and tips to streamline your finances in Germany.

1. Best Invoicing & Accounting Tools

For Simple Invoicing (Free & Low-Cost)

| Tool | Best For | Cost | Key Features | Link |

|---|---|---|---|---|

| Lexoffice | German freelancers | €9–€29/month | VAT-compliant, ELSTER integration | lexoffice.de |

| SevDesk | Small businesses | €9–€49/month | Automatic tax filings, expense tracking | sevdesk.de |

| WISO MeinBüro | Solo freelancers | €5–€15/month | Easy invoicing, tax prep | wiso-steuer.de |

| Zervant | International clients | Free (basic) | Multi-currency, simple UI | zervant.com |

| InvoiceNinja | Custom invoicing | Free (self-hosted) | Open-source, client portal | invoiceninja.com |

Pro Tip:

- German tools (Lexoffice, SevDesk) auto-generate UStVA (VAT reports) for Finanzamt

- Use QR-Rechnung (SEPA QR code) for fast bank transfers

- Use DATEV E-Rechnung for inland invoices

2. Payment Solutions for Freelancers

Bank Transfers (Überweisung) – Most Common

- Use a business account (N26 Business, Commerzbank)

- Always include:

- Your IBAN + BIC

- Invoice number + due date

- Verwendungszweck (payment reference)

Digital Payment Gateways (For Faster Payments)

| Service | Fees | Best For | Link |

|---|---|---|---|

| PayPal | 1.9–3.5% | Quick int'l payments | paypal.com |

| Wise (TransferWise) | ~0.5–1% | Multi-currency, low fees | wise.com |

| Stripe | 1.4% + €0.25 | Recurring payments (SaaS, subs) | stripe.com |

| SumUp | 1.9% | In-person card payments | sumup.de |

| GoCardless | 1% + €0.20 | SEPA Direct Debit (subscriptions) | gocardless.com |

Pro Tip:

- Avoid PayPal for large invoices (high fees, chargeback risks)

- Use Wise for international clients (better exchange rates)

Other links

English:

- Pagero: E-invoicing compliance in Germany

- Germany Visa: Opening a Bank Account for Self-Employed & Freelancers in Germany

Deutsch:

- Bundesfinanzministerium: Fragen und Antworten zur Einführung der obligatorischen (verpflichtenden) E-Rechnung zum 1. Januar 2025

- DATEV: E-Rechnungsplattform

- IHK: Business Support

- Bundessteuerberaterkammer

Step 6: Finding Work

Utilize both local and international platforms to secure freelance projects.

International Platforms

- Upwork: A global freelancing platform connecting businesses with freelance talent across 180+ countries, offering end-to-end project management tools, secure payments, and a vast range of skilled professionals from entry-level to expert

- Malt: A premium European freelance marketplace specializing in connecting businesses with top-tier independent professionals in tech, consulting, and creative fields, offering vetted talent, smart matching algorithms, and streamlined project management tools

- WeAreDevelopers: A specialized European platform connecting tech companies with pre-vetted developer talent through direct hiring and freelance projects, featuring AI matching and a focus on high-quality tech roles

- LinkedIn ProFinder: LinkedIn's freelance service marketplace that connects businesses with vetted independent professionals across consulting, design, writing, and other services by leveraging LinkedIn's professional network and profile verification system

- Joberty: A European employer review and job platform that helps freelancers and job seekers discover opportunities at tech companies while providing transparent company ratings, salary insights, and job matches based on workplace culture fit

- Fiverr: A global freelance services marketplace offering digital gigs starting at $5, where businesses can quickly hire freelancers for everything from graphic design to programming, with tiered pricing and streamlined project delivery

- Toptal: An exclusive freelance network that connects businesses with the top 3% of global freelance talent in software development, design, finance, and consulting through rigorous vetting and personalized matching

Germany-Specific Platforms

- Freelance.de: A German freelance job platform specializing in connecting businesses with highly skilled freelancers in IT, engineering, consulting and creative fields, offering curated project opportunities and professional networking features

- Freelancer.de: A German freelance platform connecting businesses with local freelancers across IT, design, engineering, and other skilled professions, offering project listings, secure payment systems, and dispute resolution

- HeyJobs.co: A freelance and temp-work German platform specializing in connecting businesses with pre-vetted freelancers and contractors for IT, creative, and marketing projects, featuring smart matching and secure payment systems

- Xing Jobs: A German-language professional networking and job platform that connects freelancers and full-time professionals with employers across DACH, offering targeted job matches, networking opportunities, and recruitment solutions tailored to the German-speaking market

- Gulp: A German freelance platform specializing in connecting businesses with highly skilled freelancers in IT, engineering, and consulting, offering smart matching, project management tools, and transparent client reviews for quality-focused collaborations

- PeoplePerHour (Germany section): An international freelance marketplace with localized German projects, connecting businesses with freelancers across tech, design, and marketing through hourly or fixed-price gigs, while offering escrow protection and AI-driven matching

Networking through events and professional associations can also lead to potential clients.

Networking & Direct Clients

- LinkedIn (optimize profile for German clients)

- Xing (German LinkedIn alternative)

- Local meetups (Meetup.com, Eventbrite)

Pro Tip: Use Kununu to check client reputations.

Pro Tips

- Maintain Accurate Records: Keep detailed records of all income and expenses to facilitate tax filings and potential audits

- Understand Scheinselbstständigkeit (False Self-Employment): Ensure you have multiple clients to avoid being classified as falsely self-employed, which can lead to legal and tax complications

- Seek Professional Advice: Consult with a tax advisor (Steuerberater) familiar with freelancing to navigate complex tax laws and optimize your financial situation

Step 7: Health Insurance, Retirement & Social Security

Mandatory for freelancers (no employer coverage)

- Health Insurance (Krankenversicherung)

- Options:

- Public (Gesetzliche Krankenversicherung - GKV): ~14–16% of income

- Private (Private Krankenversicherung - PKV): Fixed rates, better for high earners

- Compare KV Vergleich

- Options:

- Voluntary Pension Insurance (Rentenversicherung)

- Apply via Deutsche Rentenversicherung: www.deutsche-rentenversicherung.de

- Private pension plans (Riester/Rürup)

- Compare the options on Pensionfriend or ExpatAdvice

- Unemployment Insurance (Optional)

- Apply via Verwaltung Bund

Recommended Additional Insurances

- Professional Liability Insurance (Berufshaftpflichtversicherung)

- Types, coverage, and options on the Germany Visa website

- Legal Protection Insurance (Rechtsschutzversicherung)

- Disability Insurance (Erwerbsunfähigkeitsversicherung)

- Information available on All About Berlin

Final Checklist

- Register with Finanzamt (Freiberufler) or Gewerbeamt (Gewerbe)

- Get health insurance

- Open a business bank account

- Set up invoicing & accounting

- File taxes & VAT on time

- Join freelance platforms & network